As concerns about environmental sustainability and the rising costs of energy continue to mount, energy conservation equipment has emerged as a critical component in the quest for efficient energy use. Given this increasing awareness, many potential buyers wonder: is energy conservation equipment exempt from sales tax? This question opens pathways to understanding the intricate regulations governing energy-efficient technologies and their implementation.

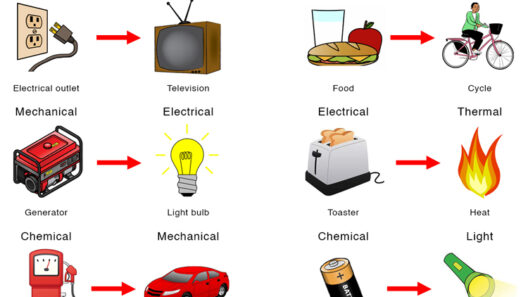

To navigate the complexities surrounding sales tax exemptions, it is essential first to delineate what constitutes energy conservation equipment. Typically, this category includes devices or systems designed to reduce energy consumption while maintaining performance levels. Examples range from advanced insulating materials and energy-efficient HVAC systems to programmable thermostats and LED lighting. These innovations not only contribute to the conservation of energy resources but also align with broader environmental goals aimed at reducing carbon footprints.

The nexus between energy conservation equipment and sales tax exemption varies significantly across jurisdictions. In the United States, tax laws differ from state to state, leading to a mosaic of regulations that can perplex even the more informed consumers. In some states, energy conservation equipment does qualify for sales tax exemptions. Legislative measures have been instituted in many regions to incentivize the adoption of energy-efficient technologies. These initiatives respond to both environmental imperatives and economic considerations, aiming to reduce the financial burdens on consumers investing in such technologies.

Understanding the rationale behind these exemptions is pivotal. The underlying motivation is twofold: facilitating the transition to renewable energy sources and fostering fiscal savings for consumers. By exempting energy conservation technologies from sales tax, states aim to make these products more accessible, potentially catalyzing widespread adoption. The logic is straightforward; the more affordable the initial investment, the quicker individuals and businesses are likely to transition toward energy-efficient solutions. This, in turn, contributes to the overarching goal of reducing aggregate energy consumption and minimizing environmental impact.

Nonetheless, the discrepancies in tax laws can create confusion. For instance, while one state may offer a generous sales tax exemption for a broad array of energy-saving appliances, another might restrict these benefits to particularly categorized technologies. Therefore, it becomes imperative for consumers to research local regulations thoroughly before making purchases. Consulting with tax experts or legal advisors who specialize in energy regulations can provide invaluable insights.

On a broader scale, these tax policies also reflect the values and priorities of a given state. States that face significant environmental challenges or those that have committed to stringent climate action plans are more likely to offer incentives for energy conservation equipment. These exemptions not only promote immediate financial relief but also signal a commitment to divesting from fossil fuels and embracing sustainable practices.

Consider the implications of these sales tax exemptions for different sectors. Residential consumers stand to gain significantly from purchasing energy-efficient appliances and systems. However, the business sector could see even more substantial benefits. In many cases, commercial entities account for a significant portion of energy consumption, so incentives to adopt energy-efficient technologies are particularly critical. By alleviating the financial burden through sales tax exemptions, governments can encourage businesses to invest in sustainable solutions, which can lead to improved operational efficiency and enhanced competitiveness in an increasingly eco-conscious market.

Moreover, it is worth noting that the exemptions for energy conservation equipment often coincide with additional programs and incentives, such as rebates and tax credits. Some states offer comprehensive incentives that make the transition to energy-efficient systems not only tax-exempt but also financially rewarding in the long run. Engaging with local utility companies or energy efficiency programs often reveals a wealth of additional options that can further contribute to reducing costs associated with energy conservation efforts.

However, despite the promising landscape of sales tax exemptions, consumers must remain vigilant. The evolution of tax policy frequently reflects changing political climates and fiscal challenges. For instance, during times of economic disadvantage, states may revisit tax structures in an attempt to bolster revenue. Therefore, the stability of these exemptions is not guaranteed, emphasizing the importance of remaining informed about legislative changes.

In conclusion, while many consumers may wonder about the sales tax implications surrounding energy conservation equipment, the answer largely depends on regional regulations and policies. The existence of exemptions is a testament to the necessity of encouraging energy-efficient practices. These legislative measures do not merely serve a fiscal purpose; they symbolize a societal commitment to advancing sustainable practices and protecting the environment for future generations. As the movement toward energy conservation gains momentum, it is essential for individuals and businesses alike to take advantage of available incentives, ensuring their investments lead to meaningful contributions to sustainability while navigating the complex web of energy regulations.