In the tapestry of modern society, the threads of climate change intricately weave through the fabric of our financial institutions, particularly those that undergird the insurance industry. The looming specter of a warming world casts long shadows on how risk is evaluated, predicted, and ultimately managed. The metaphor of insurance on the edge resonates deeply; it encapsulates the precarious balance between economic stability and environmental volatility. As increasingly unpredictable weather patterns emerge and ecosystems are disrupted, the financial ramifications ripple through both personal and corporate realms, precipitating a crisis that necessitates our immediate attention.

At first glance, the insurance sector appears robust, an unwavering pillar in the face of calamity. However, beneath this veneer lies a delicate equilibrium threatened by climate change. Each policy underwritten is a wager against uncertainty. Yet, as extreme weather events become more frequent and severe—hurricanes of unprecedented ferocity, wildfires devouring vast landscapes, and floods inundating cities—insurers find themselves on increasingly unstable ground. This is not merely an industry concern; it is a societal conundrum, affecting homeowners, businesses, and governments alike.

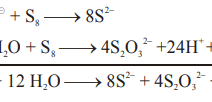

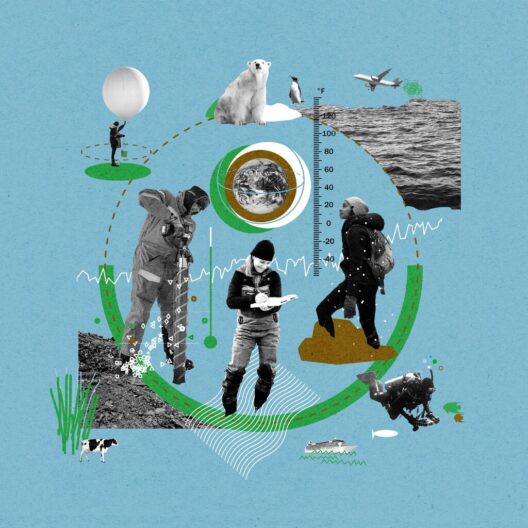

To understand the magnitude of this predicament, one must consider the metrics that inform insurance underwriting. Data analytics and actuarial science have traditionally allowed insurers to assess risk with a degree of precision. However, climate change introduces an element of unpredictability that defies historical precedents. The actuarial models of yesteryear, built on decades of empirical data, now falter in the face of rapidly changing environmental realities. The past, it seems, is no longer a reliable guide to the future.

The financial fallout is immediate and profound. As natural disasters escalate in both frequency and severity, the cost of claims rises exponentially. On a global scale, insurable losses linked to climate change exceeded a staggering $250 billion in recent years, a figure poised to grow as the climate crisis deepens. This burgeoning cost translates to higher premiums for consumers, creating a pernicious cycle: as insurance becomes less affordable, homeowners may forgo coverage, ultimately leaving them vulnerable and exacerbating the fallout of climate risks.

Moreover, the economic implications extend beyond individual policyholders. For businesses, particularly those in high-risk industries—such as agriculture, real estate, and tourism—insurance becomes a linchpin of operational viability. Without appropriate coverage, companies face existential threats that can lead to insolvency. This is a destabilizing scenario; the failure of one sector can catalyze a domino effect that impacts the broader economy. If agriculture yields diminish due to drought or flood, food prices surge, and consumers feel the pinch; if real estate values plummet in high-risk flood zones, local economies falter.

Insurance companies themselves are caught in this maelstrom. The industry’s response to climate-induced risks is a study in adaptability. Some forward-thinking insurers are reevaluating their business models, integrating climate risk assessments into their underwriting processes. This proactive approach may involve geographical risk mapping, enhanced data collection, and collaboration with climate scientists to bolster prediction accuracy. However, such reforms necessitate significant investment, both in terms of finance and human capital—resources that many insurers, especially smaller firms, might find difficult to marshal in an increasingly competitive marketplace.

Compounding these challenges is the policy landscape. Governments worldwide grapple with how to align insurance practices with climate resilience. For example, the absence of standardized guidelines means insurers often operate in a patchwork regulatory environment, complicating their ability to make coherent strategic decisions. The call for robust policy frameworks resilient to climate change has never been more critical. There exists an urgent need to create incentives for sustainable practices, empowering both insurers and insured parties to act in ways that mitigate climate-related risks.

Nevertheless, glimmers of hope emerge amid this tumult. Innovative solutions are gaining traction. Parametric insurance, which pays out based on predefined metrics rather than traditional claims processes, offers a potential lifeline for those affected by climate-related incidents. By providing immediate financial relief, such products can facilitate rapid recovery and resilience building. Furthermore, insurers are beginning to recognize the value of investing in renewable energy and sustainable projects. Such investments not only yield positive environmental outcomes but also mitigate their exposure to fossil fuel-related risks.

As the world stares into the abyss of climate change, the insurance sector plays a pivotal role as both a protector and a barometer of societal resilience. Its evolution will be critical in shaping how individuals and communities respond to the threats posed by a warming world. The industry stands at a crossroads, challenging insurers to reevaluate their purpose, to transform their practices, and to emerge not merely as purveyors of risk management, but as vanguards of sustainability.

Ultimately, the future of insurance in a warming world hinges on collective action and innovation. Stakeholders must engage in a dialogue that transcends disciplinary boundaries, bridging the gaps between science, finance, and policy. In doing so, we can foster an adaptive ecosystem capable of weathering the storms of change, ensuring that insurance remains an unwavering bastion in the face of environmental turmoil.

In conclusion, insurance on the edge epitomizes the confluence of risk and opportunity. It is a testament to our ability to navigate uncertainty while championing the principles of resilience and sustainability. With concerted effort, we can usher in a new era where the financial consequences of climate change are mitigated, illuminating a path toward a more secure and sustainable future.