Global warming is a pressing existential challenge, compelling individuals, corporations, and governments to seek effective solutions. Among the many approaches to mitigate climate change, green investments stand out as one of the most viable pathways. Investing in projects and companies that prioritize sustainability not only addresses environmental concerns but also offers lucrative opportunities in an increasingly green-conscious marketplace.

As we explore good investments for combatting global warming, it is essential to understand the scope and types of green investments that are gaining traction in today’s economy.

When considering investment options, a myriad of factors must be weighed. Investors are increasingly concerned about the viability and profitability of green investments, leading to the emergence of sustainable finance as a critical sector. Below, we examine some compelling avenues for green investments that align financial returns with ecological stewardship.

Renewable Energy: Powering a Sustainable Future

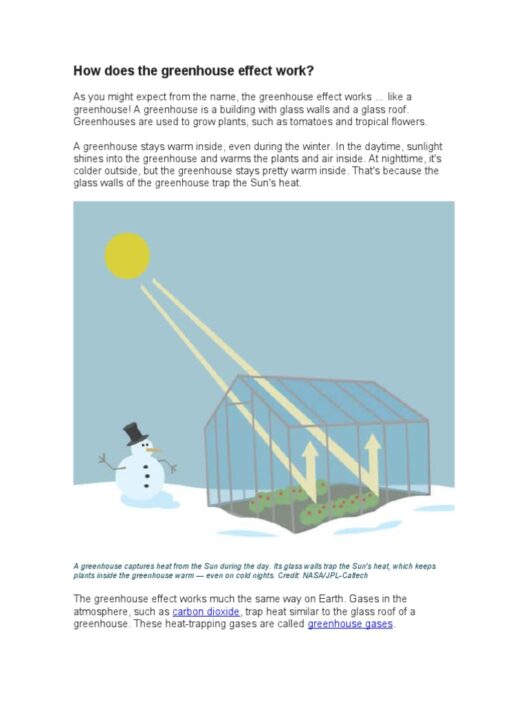

Renewable energy sources have taken center stage as pivotal components in the fight against global warming. Major segments in this category include solar, wind, hydroelectric, and geothermal energy. The transition from fossil fuels to renewables is not merely a trend; it is a necessity that governs the future of energy production. Solar energy investments, for instance, are skyrocketing due to decreasing installation costs and technological advancements, making solar farms an attractive option for both institutional and individual investors.

Wind energy is another booming sector. Wind turbines harness the natural currents in the atmosphere to generate electricity, and many countries are incentivizing the development of wind farms. The potential returns on these investments are substantial, particularly in regions with consistent wind patterns. Furthermore, governments worldwide are implementing regulations aimed at reducing carbon emissions, thus spurring demand for renewable energy sources.

In the realm of sustainable investing, energy storage technologies present a significant opportunity as well. Innovations in battery technology ensure that renewable sources can supply consistent power to the grid, thereby overcoming one of the primary limitations of solar and wind energies—intermittency. Investing in companies that specialize in energy storage solutions can yield impressive returns while supporting the transition to a decarbonized economy.

Green Real Estate: Building a Sustainable Tomorrow

Another lucrative investment avenue lies within green real estate. This sector includes properties constructed with sustainable materials and designs that prioritize energy efficiency. The growing demand for eco-friendly homes reflects a societal shift toward sustainability. Properties that incorporate green building standards—such as LEED certification—tend to experience increased valuation and rental income due to their energy-saving attributes.

Smart buildings equipped with advanced technologies optimize energy use, reduce waste, and create healthier living environments. This trend extends beyond residential properties to commercial real estate, where businesses increasingly seek sustainable office spaces to enhance corporate social responsibility profiles. Investors can capitalize on this growing market by targeting properties that are designed to minimize their carbon footprints, thereby aligning profit motives with environmental goals.

Impact Investing: Financial Returns with a Mission

Impact investing constitutes a strategy that seeks to create positive social and environmental outcomes alongside financial returns. These investments specifically target enterprises and projects that address pressing global challenges, including climate change. Various funds and initiatives are dedicated to advancing sustainability through innovative technologies and practices.

Among the sectors ripe for impact investment are clean technology startups, sustainable agriculture, and waste management solutions. For instance, companies developing biodegradable plastics or implementing circular economy models present opportunities for investors looking to support sustainable practices while earning a return.

Furthermore, as consumer behavior shifts toward eco-consciousness, brands that demonstrate a commitment to sustainability are likely to perform well in the market. Investing in socially responsible companies can thus prove advantageous financially while fostering long-term change in business practices globally.

Climate Bonds: A Financial Tool for Environmental Change

Climate bonds, often referred to as green bonds, are fixed-income instruments specifically designated to fund projects that have positive environmental benefits. These can range from renewable energy installations to energy efficiency projects and sustainable infrastructure developments. The allure of climate bonds lies in their dual capacity to offer fixed returns while simultaneously funding projects that combat global warming.

As governments and corporations continue to issue these bonds, they promote investment in the climate sector. For investors seeking exposure to green investments, climate bonds provide a relatively lower-risk avenue to support sustainable initiatives. The market for green bonds is expected to grow exponentially, making now an opportune time to engage.

Final Thoughts: Embracing the Green Investment Landscape

The urgency to tackle climate change cannot be overstated; our planet’s future depends on decisive action. The landscape of green investments offers multifaceted opportunities that not only contribute positively to environmental causes but also align with the financial aspirations of investors. By embracing renewable energy, green real estate, impact investing, and climate bonds, individuals can become part of a transformative movement toward a sustainable future.

Ultimately, when investing in options designed to mitigate the impacts of global warming, one must consider the balance between financial viability and ecological integrity. The choices made today will pave the way for tomorrow’s world, ensuring that the financial market thrives while preserving the planet for future generations.