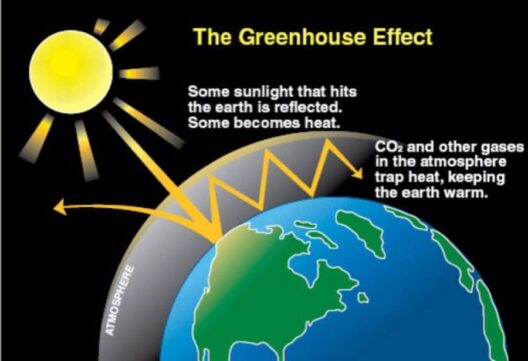

The allure of wind energy is undeniable. Often described as a clean and inexhaustible source of power, wind energy has become a cornerstone of the burgeoning renewable energy sector. However, to fully appreciate its charms, it is essential to delve deeply into the associated costs and financial implications of harnessing this inexhaustible resource. By breaking down the costs, we can gain a clearer understanding of how wind energy competes in the modern energy market.

Unpacking the Cost of Wind Energy Infrastructure

The first foray into the financial considerations surrounding wind energy must begin with infrastructure development. Wind farms require significant upfront investments for the installation of turbines, which necessitates substantial capital expenditure. Expenses include acquiring land, developing sites, manufacturing wind turbines, and constructing access roads and transmission lines. A crucial element of this infrastructure is the turbines themselves, which consist of several critical components—blades, nacelles, gearboxes, generators, and towers—that together enable wind energy to be harnessed effectively.

Economies of scale can play a pivotal role in mitigating these costs. Larger wind projects can benefit from lower per-unit expenses, enabling developers to achieve more competitive prices. Furthermore, the wind turbine market has witnessed considerable advancements in technology. As turbine efficiency has improved—yielding higher energy outputs at lower wind speeds—new installations demonstrate greater viability and reduced costs.

The operation and maintenance (O&M) of wind farms also contribute significantly to the overall cost structure. These expenses cover regular servicing, equipment repairs, and monitoring to ensure optimal performance throughout the turbine’s lifespan, which typically ranges from 20 to 25 years. While O&M costs are lower than those associated with fossil fuel plants—due largely to the absence of fuel-related expenses—they still represent a substantial commitment over the lifespan of the wind project.

Evaluating Levelized Cost of Energy (LCOE)

At the core of assessing the financial impact of wind energy lies a critical metric known as Levelized Cost of Energy (LCOE). It is a comprehensive measure that accounts for the total costs of building and operating a power-generating asset over a specified timeframe, divided by the total electricity produced. In essence, LCOE provides a standard for comparing the cost-effectiveness of different energy sources.

In recent years, wind energy LCOE has seen a dramatic decline due to advancements in technology, increased efficiency, and growing competition within the sector. Today, many onshore wind projects are capable of producing energy at costs that are competitive with traditional fossil fuels. In some regions, prices have plunged below $30 per megawatt-hour (MWh), making wind a formidable player in the energy market.

It is important to note, however, that LCOE can fluctuate based on external factors such as local resource availability, grid interconnection costs, and regulatory frameworks. Regions with consistent wind patterns naturally yield lower energy costs compared to those with sporadic winds. Additionally, innovations such as offshore wind projects further complicate the LCOE landscape, as they typically involve higher installation and maintenance costs but promise superior energy generation potential.

Financial Incentives and Subsidies: A Supporting Framework

Another crucial dimension when discussing the cost of wind energy is the role of government incentives and subsidies in reducing financial barriers. In many countries, policymakers have embraced the transition to renewable energy through supportive legislation and financial frameworks. These initiatives can significantly alleviate initial capital expenditures and bolster investments in wind energy.

Tax incentives, such as the Production Tax Credit (PTC) in the United States, have been instrumental in driving investment. This particular program grants wind developers a financial benefit based on the amount of electricity produced in the first ten years of operation. Similar policies exist in various countries, aiming to create a conducive environment for potential investors.

Furthermore, Power Purchase Agreements (PPAs) have become an essential tool in providing revenue certainty for wind developers. Through these contracts, electricity generated by wind facilities is sold to off-takers, such as utility companies or large corporations, usually at a predetermined price over an extended period. This financial predictability enables wind energy projects to garner financing on more favorable terms, ultimately reducing costs for end-users.

The Future of Wind Energy: Cost Trajectories and Market Potential

As the global energy landscape continues to evolve, the trajectory of wind energy costs is expected to follow an optimistic path. Ongoing technological advancements, coupled with the growing demand for sustainable energy sources, keep the potential for further cost reductions acutely alive. The burgeoning field of energy storage technology may also play a transformative role in enhancing the value proposition for wind power. By pairing wind energy generation with efficient energy storage systems, intermittent power generation can be smoothed, thus ensuring a continuous energy supply and improved reliability.

In conclusion, wind energy represents a complex interplay of costs and financial considerations. While initial investments can be substantial, the reductions in operating costs, competitive LCOE, and supportive policies create a favorable environment for the growth of wind energy. As a multifaceted and ever-evolving industry, wind power exemplifies the aesthetic appeal of a clean energy future—a harmonious blend of innovation, sustainability, and economic viability. The path forward holds great promise, as wind energy continues to shape the way we approach our global energy needs, urging society closer to a physical manifestation of a sustainable planet.