In an era where climate change is no longer a distant threat, insurance companies have found themselves at a critical juncture. As they navigate the complexities of risk management amid increasingly volatile environmental conditions, a pressing question arises: Do insurance companies believe in global warming? This inquiry may seem straightforward, yet it delves into deeper layers of operational strategy, economic implications, and societal responsibilities that warrant thorough exploration.

The insurance industry is fundamentally built on the principles of assessing risk and managing uncertainty. Insurance companies evaluate various factors, including environmental hazards, to underwrite policies and determine appropriate premiums. With the escalating impacts of climate change—ranging from erratic weather patterns to natural disasters—these companies are confronted with an undeniable reality. The fingerprints of climate change are indelibly etched onto the risk landscape, compelling insurers to acknowledge and strategically respond to this existential challenge.

To assess the sentiment of insurance companies towards global warming, we must first consider how they adapt their business models in response to climatic changes. A prominent trend has emerged: the increase in insurance premiums. Policyholders are witnessing soaring rates, particularly those in regions predisposed to natural catastrophes. This is not simply a consequence of heightened claims; rather, it reflects an acute recalibration of risk assessment paradigms dictated by the observed intensification of climate-related events.

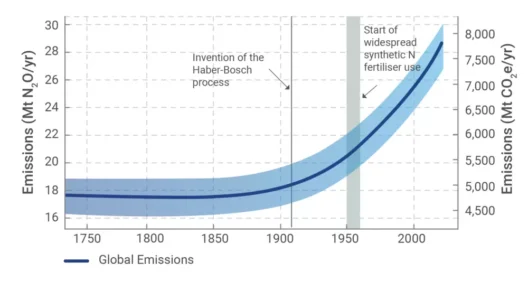

Moreover, insurance companies have begun to incorporate climate science into their actuarial models. These institutions increasingly collaborate with climatologists and environmental experts to refine their predictive capabilities. The development of complex models allows insurers to project future claims based on projected climate scenarios, which highlights their acknowledgment of global warming’s permanence. For many companies, the question is no longer if global warming is real, but rather how it reshapes their operational frameworks.

Another informative aspect of the insurance industry’s relationship with climate change is its commitment to sustainable practices. Several companies have embarked on initiatives to promote resilience and sustainability within the communities they serve. Some create insurance products specifically aimed at encouraging homeowners to adopt environmentally friendly practices, such as energy-efficient upgrades or flood mitigation measures. This not only adapts their portfolio to the evolving landscape but also positions insurers as proactive stewards of the environment.

Furthermore, climate risk has become increasingly prominent in the discourse concerning investment strategies. Insurers, who are essentially institutional investors, are beginning to divest from carbon-intensive industries and redirect capital towards sustainable ventures. This movement is indicative of a broader recognition that climate change poses not only existential risks but also economic opportunities. By investing in renewables and green technologies, they are not merely safeguarding their financial interests but also fostering a transition towards a low-carbon economy.

The implications of this evolving relationship between the insurance industry and climate change are far-reaching. As insurance companies adjust their operational strategies, they simultaneously wield substantial influence on policy and regulatory frameworks. Insurers can advocate for robust climate policies, as a stable regulatory environment minimizes their liabilities and enhances long-term profitability. Their insights can shape critical discussions around disaster preparedness, infrastructure resilience, and urban planning—all essential to mitigating the ramifications of climate change.

However, it is vital to consider the broader societal impact of the insurance industry’s recognition of global warming. The rising costs of insurance premiums, particularly for properties in vulnerable regions, raise ethical questions about equity and accessibility. Homeowners in high-risk areas face daunting challenges, as exorbitant premiums can limit access to essential coverage, effectively leaving them powerless against impending disasters. This conundrum underscores the need for innovative financial solutions and community-centered approaches to ensure that all citizens can safeguard their assets against climate-related perils.

Additionally, the disparity in how different regions report and react to climate change adds another layer of complexity. In some areas, particularly developing nations, less affluent populations may lack the financial resources to adapt to rising insurance costs or to improve resilience against climate phenomena. As such, insurance companies play a crucial role not only in risk assessment but also in promoting equity and inclusivity within their respective markets. The challenge lies in crafting policies that foster accessibility while simultaneously addressing the increased risks posed by climate change.

In conclusion, the inquiry into whether insurance companies believe in global warming unveils a tapestry woven from emerging realities of risk, investment strategies, and societal responsibilities. The axis of climatic change continues to pivot the landscape in which insurers operate, prompting a shift towards sustainable practices that encompass both environmental mandates and economic fortunes. Recognition of climate change as a central tenet of organizational strategy is vital not only for insurance companies but also for the communities they serve. In navigating the turbulent waters of climate risk, insurers possess the potential to be key actors in the transition towards a resilient, sustainable future.