Wind energy has emerged as a formidable player in the renewable energy landscape, widely recognized for its environmental benefits and sustainability. However, when assessing wind power generation, one must also consider the nuanced financial dimensions that influence its deployment and ongoing operations. From installation to maintenance and the long-term economic outlook, the costs associated with harnessing the wind are multifaceted. This article delves into these financial aspects, unraveling the complexities and providing a comprehensive analysis of how much wind energy truly costs.

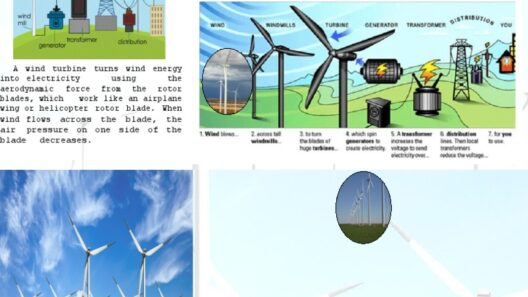

Understanding the costs of wind energy begins with a breakdown of different expenditure categories involved in the lifecycle of wind power generation. These include initial capital investment, operation and maintenance (O&M) costs, and the levelized cost of electricity (LCOE). Each component plays a pivotal role in determining the overall viability and competitiveness of wind energy.

Initial capital investment constitutes the most substantial component of the financial framework surrounding wind energy. This preliminary outlay encompasses the costs associated with purchasing land, procuring turbine equipment, and the intricate installation processes necessary to set up wind farms. Wind turbines are not merely mechanical apparatuses; they are technologically advanced machines requiring significant investment. The procurement of a single turbine can range from $1.3 million to $2.2 million, depending on its size and capacity.

In addition to the turbine costs, land acquisition plays a critical role in the overall initial outlay. Wind farms are often located in areas with optimal wind conditions, which may require investment in land leases or outright ownership. Furthermore, additional infrastructure is necessary to facilitate power generation and distribution, including the construction of access roads and transmission lines. These infrastructural investments can significantly influence the total capital expenditure.

Operation and maintenance costs are another integral aspect of the financial analysis of wind energy. Once operational, wind turbines require ongoing maintenance to ensure their efficiency and longevity. These costs typically account for around 20% of the total lifecycle costs of a wind farm. Regular inspections, repairs, and parts replacement are essential to maintaining optimal turbine performance. While O&M costs can vary significantly based on location and turbine technology, they generally average around $42,000 per megawatt (MW) per year.

The levelized cost of electricity (LCOE) is a critical financial metric that provides insight into the cost of generating electricity over the lifespan of a wind farm. LCOE factors in all costs — both fixed and variable — spread over the total electricity production throughout the life of the project, typically around 20 to 30 years. Wind energy’s LCOE has significantly decreased in recent years, making it a competitive choice compared to fossil fuels. As of recent estimates, the LCOE for onshore wind power averages between $30 and $60 per megawatt-hour (MWh), rendering it cheaper than many conventional energy sources.

The decrease in LCOE can be attributed to a myriad of factors, including advancements in turbine technology, increased efficiency, and economies of scale achieved through larger wind farm projects. Innovations in turbine design have led to the development of larger, more efficient models capable of generating more energy at lower wind speeds. Such improvements reduce the number of turbines needed, directly influencing the LCOE downward.

In evaluating the financial viability of wind energy, it is also crucial to consider external factors that can impact costs. For instance, government policies and incentives play a significant role in shaping the economic landscape for renewable energy projects. Tax credits, grants, and subsidies can drastically reduce upfront costs and improve the overall return on investment. The Production Tax Credit (PTC), for example, has been instrumental in supporting the growth of the wind energy sector in many countries, enabling developers to benefit from significant tax deductions based on the energy produced.

Moreover, the market for renewable energy certificates (RECs) represents another financial aspect that can influence the attractiveness of wind power. RECs can be sold or traded as commodities, providing an additional revenue stream for wind farm owners. The value of these certificates fluctuates based on supply and demand dynamics in the renewable market.

Global market trends also exert influence over wind energy costs, with international trade policies and tariffs impacting the price of imported turbine components. The imposition of tariffs on materials essential for wind turbine manufacturing can inadvertently drive up costs, affecting project feasibility and overall market competitiveness.

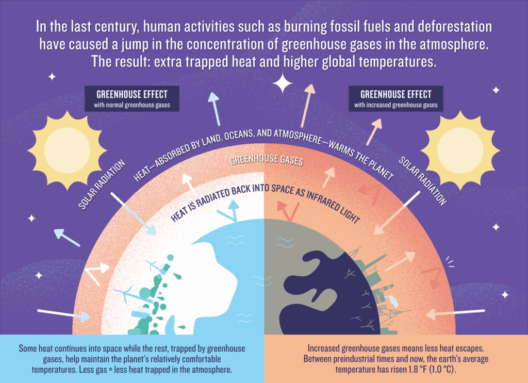

As governments worldwide shift toward renewable energy goals to combat climate change, investment in wind power presents a viable route for achieving sustainable energy solutions. Industry stakeholders must continuously assess the cost dynamics to develop strategic approaches to financing and investment that will optimize both environmental and economic outcomes.

In summary, the financial analysis of wind energy reveals a complex interplay of upfront capital investment, operational expenses, and regulatory factors. While initial costs may appear daunting, the long-term benefits and decreasing LCOE trends highlight wind energy’s unique position as a viable alternative in the quest for sustainable energy. Ongoing technological advancements and supportive policy frameworks will further enhance the economic landscape, fostering the growth of wind power generation as a cornerstone of our energy future.