As the ramifications of climate change increasingly manifest in extreme weather patterns, rising sea levels, and altered ecosystems, the real estate market stands at a precipice. Properties, traditionally viewed as steadfast investments, are now subject to fluctuations that reflect environmental vulnerabilities. This landscape is not solely about housing availability; it is shifting under the pressure of climate realities.

The connection between climate change and property values is becoming undeniable. Research suggests that properties located in areas prone to environmental hazards may experience a depreciation in value. The anticipation of rising insurance premiums, coupled with potential costs associated with retrofitting buildings for climate resilience, creates a multifaceted pressure on homeowners and investors alike.

In coastal regions, where the specter of rising sea levels looms large, the real estate implications are immediate. Waterfront properties, once the pinnacle of desirability, are increasingly associated with risk. Investors are beginning to reassess the stability of such investments. If existing residents find it challenging to secure affordable insurance—or if insurers withdraw altogether—property values may slide as the perception of risk escalates. Furthermore, municipalities may impose stricter regulations or zoning changes in an attempt to mitigate flooding risks, directly impacting property and investment potential.

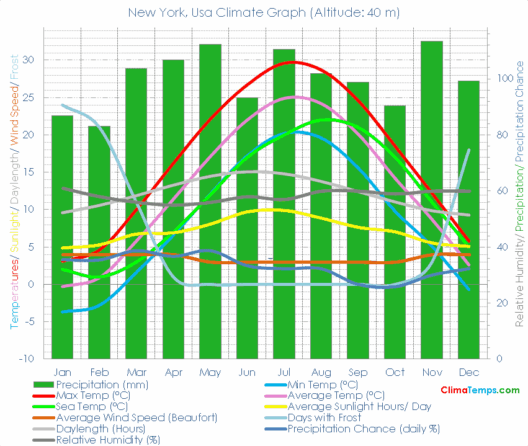

Conversely, some areas are experiencing inadvertent booms due to market responses to climate change. Regions once deemed less desirable are now emerging as bastions of stability. As temperatures rise, locations with more temperate climates may find increased demand. For instance, northern cities historically known for their cold winters might attract populations from traditionally hotter southern regions. This relocation phenomenon introduces new dynamics that reshape property values, creating opportunities for development and investment in previously overlooked areas.

Urban environments are also being transformed by climate imperatives. Cities are increasingly prioritizing sustainability in urban planning, leading to a demand for properties with eco-friendly features. Green buildings, energy-efficient systems, and sustainable landscaping are not just trends; they represent a long-term strategy for property value retention. Investors recognizing the inevitability of climate-aware building practices are poised to reap substantial benefits as municipalities implement stricter building codes favoring sustainability.

The disparity in how different property types are evaluated in light of climate change is significant. Commercial real estate, particularly in vulnerable urban areas, faces unique challenges. As companies increasingly adopt corporate social responsibility policies that encompass environmental sustainability, they may shun properties that do not align with their ethical objectives. The shift towards greener facilities can drastically alter demand dynamics, with eco-friendly buildings being valued higher than conventional counterparts.

Alongside these developments, it becomes crucial to consider the role of public perception. The collective consciousness surrounding climate change directly influences buyer behavior. Buyers are increasingly gravitating towards locations that align with their values—areas committed to energy efficiency, sustainable practices, and climate resilience. Socioeconomic stratification thus affects market movements; affluent buyers often have the means to invest in high-performing properties that promise environmental stewardship, whereas lower-income families may find themselves relegated to zones lacking essential infrastructure, which may exacerbate their vulnerability to climate effects.

The phenomenon of “climate gentrification” is emerging as a critical area of concern. As neighborhoods vulnerable to climate change undergo revitalization efforts—often financed by more affluent newcomers—existing residents may find themselves displaced due to soaring property values. This creates a further divide in the socio-economic fabric and raises questions about equitable access to resilient housing in the face of environmental challenges.

Moreover, the era of remote work has catalyzed a transformation within the commercial real estate market. As businesses adapt to hybrid models, they are reevaluating the necessity of large, central office spaces. Properties that offer flexible workspaces in areas less susceptible to climate volatility may indeed see an upsurge in demand. This shift may fundamentally alter the investment landscape as companies seek to mitigate risks tied to environmental damages.

Looking ahead, it is clear that continued dialogue regarding regulations, urban planning, and community engagement will be essential in navigating the intersection of real estate and climate change. Policymakers must craft initiatives that not only address immediate threats but also foster long-term sustainability. Investments in infrastructure, such as flood defenses, sustainable public transport, and green spaces, can nurture environments where property values can stabilize despite the ever-present climatic disruptions.

The financial repercussions of climate change on real estate are increasingly intertwined with social and environmental dimensions. Evaluating property values through a climate lens necessitates an understanding of the broader implications—economic, ethical, and communal. As society grapples with these changes, the future of real estate will ostensibly rest upon not only the preservation of property values but the commitment to fostering resilient communities capable of weathering the storms ahead.

In summary, the real estate sector is experiencing a paradigm shift catalyzed by climate change. From coastal properties at risk of flooding to urban environments prioritizing sustainability, the pressures on property values are palpable. Stakeholders across the spectrum—from buyers and investors to policymakers—must engage in conversations that recognize the complexities at play. The challenges posed by global warming cannot be ignored; they demand a nuanced approach to ensure that real estate evolves in harmony with an unpredictable climate future.