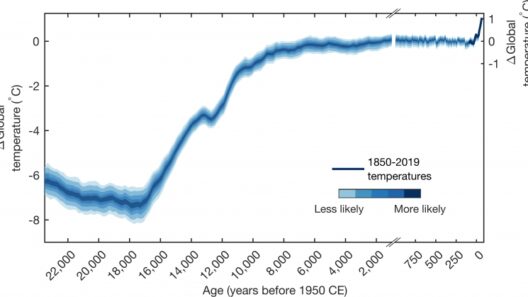

The climate economy is an intricate web that intertwines the effects of global warming with the trajectory of financial markets and economic systems. The persistent rise in global temperatures, primarily driven by anthropogenic greenhouse gas emissions, has far-reaching ramifications not just for the environment, but also for the fabric of our financial future. Observing how climate-related phenomena influence economic behavior reveals a complex interplay marked by urgency and opportunity.

As the planet warms, we witness the emergence of climate risk as a salient concern within the realm of economic forecasting. Extreme weather events—such as hurricanes, wildfires, and flooding—are becoming increasingly regular. These occurrences lead not only to immediate impacts on human lives but also create significant disruptions in supply chains, damage to infrastructure, and substantial financial losses. Consequently, businesses face heightened insurance premiums and potential insolvencies proportional to their exposure to climate-related vulnerabilities.

Moreover, the economic repercussions of climate change extend beyond immediate damage. Long-term shifts in climate can undermine agricultural productivity, a sector that is pivotal to many economies around the globe. Changing weather patterns threaten crop yields, disrupt livestock operations, and can result in food scarcity. In a world already grappling with fluctuating food prices, this trend is alarming. The agricultural sector’s struggle against climate change illustrates the necessity of integrating sustainability into economic planning and investment strategies.

Transitioning towards renewable energy and sustainable practices offers a counter-narrative to the impending dangers of climate change. The burgeoning green economy is poised to reshape both industries and financial markets. Investments in renewable energy technologies, such as solar and wind, have gained momentum, catalyzing job creation and fostering innovation. Countries are increasingly harnessing these resources in a bid to reduce reliance on fossil fuels, promoting national energy security while simultaneously addressing global warming.

Government policies play a pivotal role in itemizing the progression of the climate economy. Regulatory frameworks that incentivize green technologies—such as tax credits, subsidies, and research grants—are becoming commonplace. These initiatives serve not only to mitigate climate change but also to stimulate economic growth. The integration of carbon pricing mechanisms encourages corporations to reduce their carbon footprints, aligning environmental stewardship with fiscal prudence. As businesses recognize the financial benefits of sustainable practices, the shift towards green innovations is accelerating.

However, navigating the climate economy is fraught with challenges. Environmental, social, and governance (ESG) issues are gaining prominence within investment circles, revealing an increased demand for corporate transparency regarding sustainability. Investors are becoming more discerning, seeking to align their portfolios with climatesmart practices. Companies failing to adapt to these new expectations risk being perceived as obsolete. Thus, the pursuit of a sustainable business model is no longer merely an ethical imperative but a financial necessity.

Moreover, as climate change exacerbates inequality—particularly in developing nations—the ethical dimensions of economic strategies deserve scrutiny. Vulnerable populations bear the brunt of environmental degradation, experiencing disproportionate impacts from climate-related disasters. This inequity presents not only a moral conundrum but also a potential source of socio-economic instability that could reverberate through global markets. Addressing the intersectionality of climate change and economic equity is essential for fostering resilient and just economies.

The evolving landscape of the climate economy requires a nuanced understanding of consumer behavior. Growing awareness of climate issues has given rise to a new cohort of environmentally conscious consumers. Their choices increasingly shape market trends, as sustainable products gain preference over conventional alternatives. This shift compels businesses to innovate and diversify their offerings, driving a competitive edge in a marketplace that increasingly values eco-friendliness.

Importantly, the financial sector itself must adapt to a changing climate. As climate risks materialize, financial institutions face pressures to recalibrate their risk assessment models. The shift towards climate-resilient investments necessitates the incorporation of sustainability metrics into lending practices and investment decisions. Institutions must grapple with the concept of stranded assets—investments in fossil fuels that may become worthless as the world transitions to a low-carbon economy. Steering capital towards sustainable ventures not only protects financial interests but also supports global efforts to mitigate climate change.

As climate-related initiatives flourish, new financial instruments emerge. Green bonds, for instance, provide financing for projects with environmental benefits. This trend reflects a broader effort to harness the capital markets to address climate challenges, demonstrating the potential for innovative financing solutions to spur economic growth while serving environmental goals. The proliferation of such instruments underscores the interdependence of financial and ecological resilience.

In conclusion, the climate economy underscores an essential truth: the ramifications of global warming extend far beyond environmental degradation. As financial markets adapt to climate-related risks and opportunities, a reconfiguration of economic priorities emerges. Embracing sustainable practices is no longer merely a choice but a pressing obligation. The future will likely be shaped by those who understand that safeguarding our planet is synonymous with safeguarding our economic future. Recognizing the interconnectedness of climate change and economic vitality is paramount for steering our world towards a resilient, sustainable future.