In recent years, the urgency surrounding climate change has reached a crescendo. As evidence mounts regarding the dire impacts of global warming, investors, regulators, and businesses are increasingly focused on how climate-related risks might jeopardize financial stability. Central to this discussion is the climate risk rule proposed by the U.S. Securities and Exchange Commission (SEC). Officially named the “Rule for the Disclosure of Climate-Related Risks,” this initiative seeks to enhance transparency and ensure that investors are adequately informed about how climate change might affect their investments. But what are the fundamental tenets of this rule, and why does it carry exorbitant significance for both the financial sector and the environment?

The Rule for the Disclosure of Climate-Related Risks centers around the notion of materiality. Under the proposed rule, companies are mandated to disclose information regarding their exposure to climate risks. Materiality concerns the relevance and significance of certain risks to shareholders; hence, if climate risks are deemed material, failing to disclose them could be construed as misleading. Investors have a prerogative to understand the potential vulnerabilities of their investments, and this guideline seeks to illuminate those risks.

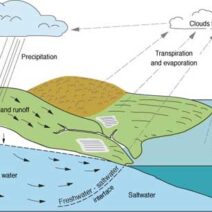

Now, let’s pose a playful question: How can a seemingly abstract concept like climate change truly affect the bottom line of a corporation? As companies increasingly rely on natural resources, shifts in climate can lead to operational disruptions, regulatory changes, and even reputational damage. For example, extreme weather patterns—be it droughts, floods, or wildfires—can devastate supply chains and impact productivity. Clearly, in today’s interconnected world, climate risk is not a peripheral issue, but instead poses a substantial challenge which directly bears on corporate profitability.

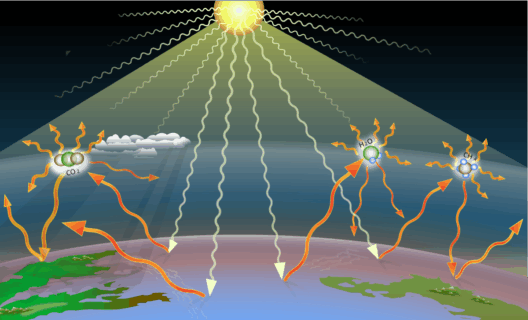

Moreover, investors are becoming cognizant of the fact that traditional risk assessment models may no longer suffice. Incorporating climate-related variables into risk analysis not only expands the framework for assessing investments but also aligns with the broader societal shift toward sustainability. The SEC’s climate risk rule recognizes this evolving landscape and responds by ensuring that companies engage in thoughtful assessments of how environmental factors could impact their financial health. This may include evaluating potential physical risks related to climate change, as well as transitional risks associated with a global move toward decarbonization and sustainability.

One of the salient features of the rule is the emphasis on a company’s governance and strategy regarding climate risks. Organizations are encouraged to articulate their approach to managing these risks, thus fostering a culture of accountability and a shift towards aligning corporate objectives with broader environmental goals. This aspect not only enhances investor confidence but also engenders a more robust dialogue about sustainability at the boardroom level, catalyzing a paradigm shift in corporate governance practices.

However, there exists a perceptible challenge in implementing this framework. The language surrounding climate risk can be nebulous at best. Many businesses may struggle to accurately gauge what constitutes a material climate risk. This ambiguity, if left unaddressed, could foster inconsistency in reporting practices across varying sectors. To mitigate this potential pitfall, it’s vital that the SEC and industry stakeholders engage in a concerted effort to develop clear guidelines and educational resources. A standardization of metrics would bolster comparability and enhance the clarity of disclosures.

Equally crucial is the notion of accountability. The SEC’s climate risk rule proposes that companies disclose not only current but also forward-looking information concerning their climate risks. This leap into predictive assessments promotes a proactive stance rather than a reactive one. It challenges organizations to think critically about the ramifications of climate change not just on their operations but also on the communities and ecosystems they impact.

In essence, this rule represents a broader movement toward integrating environmental considerations into the fabric of financial decision-making. Financial markets are beginning to reflect the understanding that sustainability is intricately tied to long-term viability. This acknowledgment sets a precedent for future regulatory measures and corporate responsibilities tied to environmental performance.

As stakeholders scramble to adapt to these regulatory changes, the question arises: will such a shift spur innovation or simply result in compliance bureaucracy? On one hand, enhanced transparency around climate risks could catalyze investment into sustainable practices and technologies, sparking a new wave of innovation. On the other, there exists a peril that companies may merely view compliance as a checkbox exercise, focusing more on the quantitative aspects of reporting rather than the qualitative changes required for genuine sustainability.

In conclusion, the Rule for the Disclosure of Climate-Related Risks serves as a critical touchstone in the evolving landscape of environmental governance and corporate responsibility. By mandating companies to disclose climate risks, it aims to foster an accountability framework that not only reassures investors but also incentivizes businesses to align their operational practices with ecological imperatives. As we navigate this complex interplay between finance and sustainability, the efficacy of this rule will ultimately depend upon its implementation and the degree to which companies embrace the opportunity to innovate towards a sustainable future. Indeed, the stakes are high—both for the environment and for the stability of global financial markets. Will the business community rise to the occasion or falter under the weight of compliance? Only time will unveil the answer.