The narrative surrounding climate change often evokes a dizzying array of images: melting glaciers, barren landscapes, and catastrophic storms. Yet, amidst this turmoil lurks a far more insidious adversary – the climate tax. It is a shrouded specter that hovers over our wallets, curtailing financial freedom while masquerading as a necessary step towards environmental justice. Understanding how global warming affects our personal finances is vital to grasping the broader implications of this existential crisis.

At its core, the climate tax is akin to an invisible hand that, instead of guiding us toward prosperity, nudges us toward fiscal restraint. This tax is not merely a burden; it is a reflection of the economic realities that stem from our collective reliance on fossil fuels. Just as a spider’s web ensnares its prey, the double-edged sword of climate policies entraps consumers in a costly environment that jeopardizes both our ecological future and economic stability.

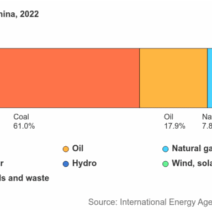

The climate tax manifests in numerous ways, infiltrating everything from utility bills to groceries. For instance, as emissions regulations tighten, energy producers are compelled to reduce their carbon footprints — often leading to increased energy costs. Consumers find themselves shouldering the burden. Rising utility bills are no longer merely a seasonal inconvenience; they are a constant reminder of the financial toll of climate change.

The ripple effect does not stop at energy expenses. Transportation, a significant contributor to greenhouse gas emissions, often sees increased costs as well. Transitioning from gasoline-powered vehicles to electric alternatives may alleviate some long-term expenses; however, the initial investment can be staggering. Furthermore, as governments impose incentives to move away from fossil fuels, the costs of traditional fuels often surge as demand shifts. Consequently, we are met with the peculiar irony of paying for a cleaner future through an inflated present.

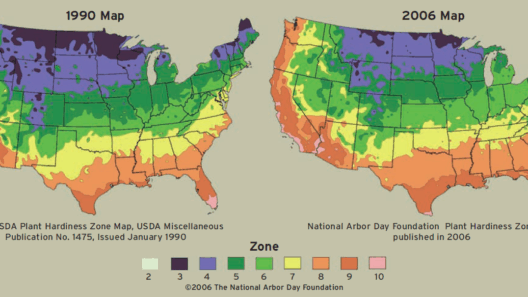

Moreover, as agriculture grapples with the repercussions of climate change — such as droughts, flooding, and erratic weather patterns — food prices climb steeply. A harvest that once flourished can become a phantom, leaving us to confront the ever-increasing prices at the grocery store. This economic paradigm forces consumers into a precarious balancing act: prioritizing environmental sustainability while navigating the high stakes of everyday costs.

The climate tax extends its far-reaching grasp into insurance markets. Over time, as natural disasters escalate in frequency and intensity, the risk to properties and businesses surges. Insurers adjust their policies accordingly, resulting in higher premiums that become an unrelenting drain on personal finances. Homeowners find themselves painfully aware that their mortgage payments are not the sole burden; rising insurance costs are an additional weight that only exacerbates their economic woes.

Interestingly, this ecological challenge presents an opportunity for innovation and investment. As businesses strive to adapt to the new climate reality, some seek solace in renewable energy sources. Solar panels, wind turbines, and energy-efficient technologies offer a glimmer of hope — a path toward reducing long-term expenses. However, the initial financial leap can feel daunting. The promise of savings draws many in, yet the immediate costs evoke an understandable hesitance. In many ways, investing in sustainability feels reminiscent of planting a seed; the initial effort yields uncertain outcomes but, with patience, can flourish into a bounty.

The taxation associated with climate change is more than monetary; it represents a profound philosophical pivot. Invoking a moral imperative, society is urged to consider the ecological ramifications of our choices. Choices made today can either sow the seeds of destruction or pave the way for a rejuvenated planet. In this sense, the climate tax prods us into critical self-reflection. It stands as a stark reminder that individual contributions, whether they manifest in small lifestyle changes or larger societal shifts, reverberate within the greater tapestry of existence.

As the fabric of our environment shifts under the weight of sheer necessity, it compels us to rethink our fiscal strategies. The climate tax incentivizes a greener economy, potentially accelerating the transition to sustainable practices. From electric vehicle production to renewable energy initiatives, the paradigm shift may well redefine fiscal landscapes as we know them. This metamorphosis acknowledges that economic growth is no longer synonymous with environmental degradation. Rather, it posits that a sustainable approach can yield enduring prosperity.

However, the path to such a transformation is bittersweet. While the climate tax represents a necessary recalibration of financial considerations, it also serves to underscore societal inequities. Low-income families are particularly vulnerable to the repercussions of climate change and often bear the brunt of such taxation. As energy bills and food prices soar, the impact on everyday survival becomes strikingly apparent. It raises an indispensable question: who bears the responsibility for ensuring that the shift to sustainability is equitable?

Yet, amid the challenges posed by climate taxes, the call for accountability resonates louder than ever. Governments, corporations, and consumers alike have a role to play in shaping a resilient, flourishing future. By fostering sustainable practices and prioritizing clean energy, a more harmonious balance can emerge — one where environmental vitality and financial stability synergize rather than compete.

In conclusion, the climate tax looms large, revealing the complex interplay between global warming and our personal wallets. This multifaceted issue transcends financial burdens, prompting introspection and encouraging innovation. As society grapples with the implications of climate change, embracing adaptation becomes imperative. We must remember that our choices today reverberate far beyond our immediate sphere, influencing the trajectory of tomorrow’s economic landscape. The fight against climate change is not merely an abstract consideration; it is, at its heart, a commitment to fostering a sustainable, just future for all.