Wind energy stands as a beacon of hope in the struggle against climate change; a dynamic force harvested from the very breath of the Earth. Its allure stems not only from its environmental advantages but also from an evolving economic landscape that shapes our understanding of its financial feasibility. Yet, beneath the glossy surface of sustainability lies an intricate web of costs that requires meticulous examination. This article delves into the multifaceted financial aspects of wind power generation, illuminating both the initial investments and the long-term implications that dictate its viability in the energy portfolio of tomorrow.

The Infrastructure: Building the Foundation of Wind Power

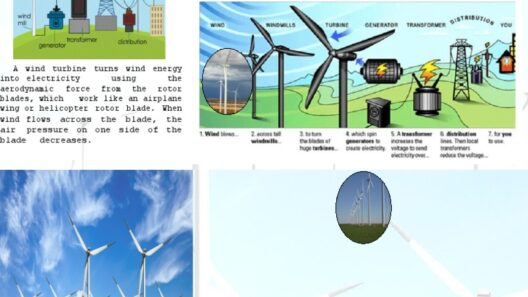

At the outset, one must consider the formidable financial commitment necessary to erect a wind power installation. The process is akin to constructing a robust fortress against the elements—each tower representing a stronghold in the siege against carbon emissions. The initial capital costs, estimated at around $1,200 to $5,000 per kilowatt depending on location and technology, encompass a multitude of factors, including land acquisition, turbine deployment, and the necessary infrastructure to connect to the existing electrical grid. These costs can vary widely, influenced by site assessments, permitting regulations, and the logistical challenges of transporting gigantic turbines.

Yet, this is merely the tip of the iceberg. In addition to capital expenditure, developers must navigate operational expenditures, which include maintenance, insurance, and labor. The savvy investor realizes that while wind resources are free and abundant—akin to the flowing rivers of yore—producing that energy comes at a price. Consequently, a thorough financial analysis must account for the balance between these upfront costs and the ongoing operational commitments required to keep the wind turbines spinning.

The Windfall: Operational Efficiency and Cost Savings

One of the most exquisite virtues of wind power lies in its minimal fuel costs. The winds that propel these turbines are inexhaustible: perpetual and free, untouched by market volatility. Operational efficiency therefore plays a crucial role in determining the overall economics of wind energy. Over the operational lifespan of 20-25 years, wind farms often achieve a capacity factor of 35-45% or more, depending on technology and location. This metric—this critical performance indicator—reveals how effectively the turbines convert wind into usable energy. High capacity factors provide more energy output without proportionally increasing costs, leading to reduced costs per megawatt-hour (MWh) produced.

Moreover, advancements in turbine technology have spurred a dramatic reduction in costs. The recent years have witnessed significant enhancements in turbine efficiency, with larger models harnessing more wind energy than their predecessors. The scalability of turbine installations also plays a key role in bringing costs down; as utility-scale projects proliferate, economies of scale kick in, allowing developers to negotiate lower prices for components and services. Such progress transforms wind energy from a nascent concept into a mainstream contender—a financial windfall for those with foresight and strategic investment.

Navigating Financial Incentives: Subsidies, Grants, and the Power of Policy

Yet, even the most well-constructed plans can be derailed by unfavorable market conditions. Enter the role of government incentives—an intricate dance of policymaking and financial strategy designed to bolster wind energy adoption. Federal tax credits, such as the Production Tax Credit (PTC) and the Investment Tax Credit (ITC), serve as vital financial lifelines that help to mitigate initial investments. These credits provide a significant offset, effectively reducing the cost burden on project developers and enhancing the return on investment.

Furthermore, various states have instituted Renewable Portfolio Standards (RPS) that mandate utilities to source a specific percentage of their energy from renewable sources. These policies propel wind energy into the limelight, ensuring its societal and economic support. As developments unfold, the financial landscape continues to evolve, encouraging private investment and fostering innovation. The significant influx of capital can often capture the imagination—like a storm gathering strength before unleashing a tempest of positive change.

While these incentives create a more favorable financial climate, the strong interplay between policies, economics, and market conditions presents challenges. The political landscape can be unpredictable, and prospective investors must be astute, gauging the potential longevity of favorable terms amid fluctuating subsidies and legislative volatility.

The Full Spectrum: Long-Term Outlook and Sustainability

As we navigate the labyrinth of wind energy finance, it’s prudent to consider the full spectrum of its costs. A holistic view reveals long-term savings that far outweigh initial investments. Wind energy not only reduces operational costs over time with low maintenance needs, but it also mitigates the economic repercussions of fossil fuel dependency—volatile prices, supply chain disruptions, and environmental liabilities.

In the grand tapestry of energy generation, wind power emerges as a sustainable solution to our pressing energy needs. Indeed, the conversation around the cost of wind energy is not merely financial; it encapsulates an ideological shift towards a cleaner future. Each wind turbine erected is a statement, a declaration of intent, and a step towards a sustainable bottom line. Through understanding its costs and financial dynamics, society can harness the wind towards a horizon filled with promise.

In summation, assessing the cost of wind energy is a nuanced endeavor that intertwines various financial considerations—from capital expenses to operational efficiencies and the influence of policy frameworks. As we chart our course through the winds of economic change, it is essential to remain vigilant and informed, allowing us to ride the gusts of opportunity into a cleaner, greener future.